If you’re investing in the Nepali share market, chances are you’ve already come across Mero Share. This digital platform, launched by CDS & Clearing Limited (CDSC), has transformed the way investors apply for IPOs, track their holdings, and manage their Demat accounts. In this guide, we’ll explore everything you need to know about Mero Share in Nepal — from setup to advanced features, security tips, and frequently asked questions.

What is Mero Share?

Mero Share is an online system that gives investors access to their Demat accounts. It works as a bridge between you (the investor), your Depository Participant (DP), and CDSC. Through the web portal meroshare or the mobile app, you can perform nearly all share-related activities without having to visit your bank or broker physically.

Why is Mero Share Important in Nepal?

Before Mero Share, investors had to rely heavily on paper forms, manual bank processes, and long queues. Today, almost every IPO and FPO application in Nepal goes through the Mero Share ASBA system.

Here’s why Mero Share has become essential:

1. Convenience: Apply for IPOs or check allotment results from your phone.

2. Transparency: Track blocked amounts, refunds, and share allotments in real time.

3. Security: Dematerialized shares reduce the risk of physical share certificates being lost or forged.

4. Accessibility: Anyone with a Demat account and an internet connection can use it.

Key Features of Mero Share

Portfolio Tracking

View your Demat account balance, holdings, and current market value.

IPO / FPO / Right Share Applications

Use the ASBA system to apply directly. Funds remain in your bank until allotment.

Allotment Results

Instantly check if you were allotted shares after an IPO.

Transaction History

Detailed logs of purchase, sales, and corporate actions.

Corporate Actions

Notifications for dividends, bonus shares, and rights issues.

Account Management

Update details, check nominee information, and view bank linkage status.

How to Get Started with Mero Share in Nepal

Step 1: Open a Demat Account

1. Visit a bank or brokerage licensed as a Depository Participant (DP).

2. Submit KYC documents: citizenship, passport-size photo, and bank details.

Step 2: Request Mero Share Activation

1. Fill out the Mero Share request form at your DP.

2. You’ll receive login credentials (username and password).

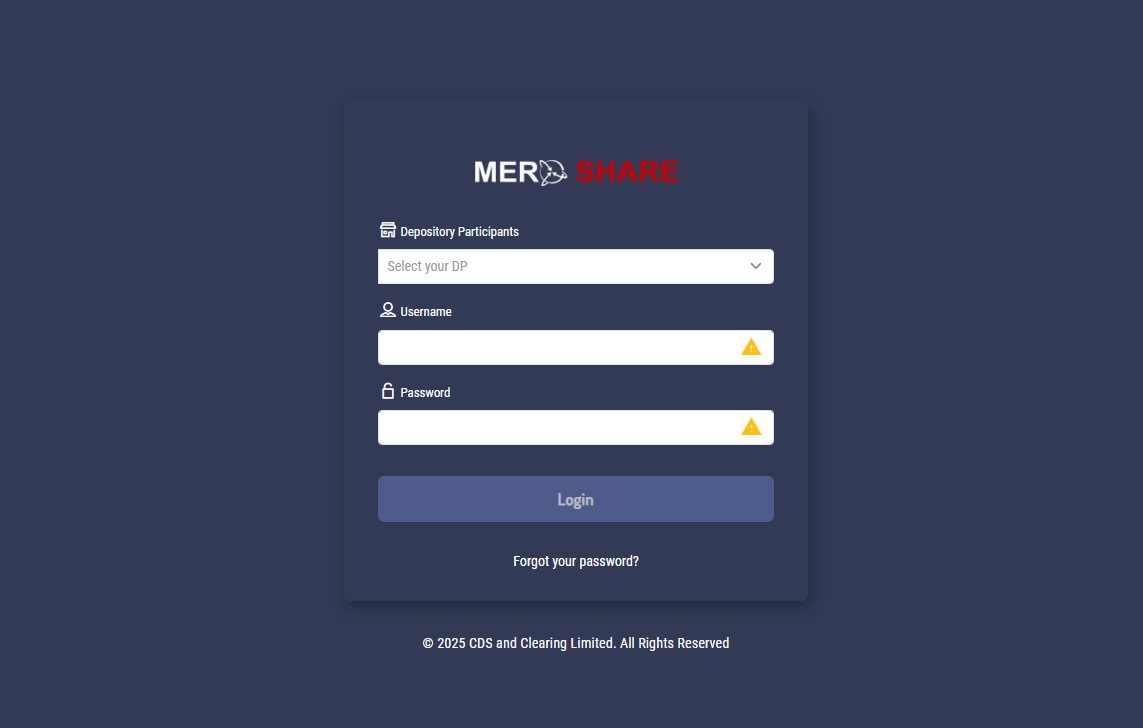

Step 3: Log in to Mero Share

1. Go to meroshare.cdsc.com.np or download the official app.

2. Select your DP, enter your BOID, username, and password.

How to Apply for IPOs via Mero Share

Applying for IPOs is the most popular use of Mero Share in Nepal. Here’s the step-by-step process:

Login to Mero Share.

Navigate to My ASBA → Current Issue.

Select the IPO you want to apply for.

Enter the number of units (usually 10 units minimum).

Confirm your bank account details (linked during Demat registration).

Submit the application.

Funds are blocked in your account until allotment. If you don’t get shares, the blocked amount is released automatically.

Common Issues and Solutions

Problem Possible Cause Solution

Cannot log in Wrong DP selected Always choose your registered DP from the dropdown

Invalid BOID Typing mistake Verify your 16-digit BOID carefully

Password expired CDSC auto-expiry Use “Forgot Password” to reset

IPO application failed Bank linkage issue Ensure your bank account is correctly linked

Security Tips for Mero Share Users

Since Mero Share deals with your financial data, here are some important safety practices:

Always use the official website or app.

Avoid logging in from public computers or shared Wi-Fi.

Create a strong, unique password.

Regularly update your details with your DP.

Be cautious of phishing emails or fake websites.

FAQs about Mero Share in Nepal

1. What is BOID in Mero Share?

BOID (Beneficiary Owner Identification) is a 16-digit number assigned to your Demat account. It’s required for all share transactions.

2. Can I apply for multiple IPOs from one Mero Share account?

Yes, you can apply for any number of IPOs, as long as they are open for subscription.

3. How do I check IPO results in Mero Share?

Go to My ASBA → Application Report. You’ll see whether your application was successful.

4. What happens if I forget my password?

Use the Forgot Password option on the login page. Reset link will be sent to registered email id.

5. Can NRNs (Non-Resident Nepalis) use Mero Share?

Yes. NRNs with a valid Demat account and a bank account in Nepal can use Mero Share like any local investor.

6. Is Mero Share free to use?

CDSC may charge a small annual fee (often collected by your DP). The exact fee varies depending on your service provider.

The Future of Mero Share in Nepal

As more Nepalis participate in the stock market, Mero Share will continue to be the backbone of digital investing. Plans are underway to integrate advanced features such as two-factor authentication, better mobile UI, and faster refund tracking.

This evolution will make the platform more user-friendly and secure, encouraging more first-time investors to join Nepal’s capital markets.

Conclusion

Mero Share in Nepal is more than just an online portal — it is a gateway to the country’s financial ecosystem. From applying for IPOs to tracking your portfolio, it simplifies the entire investing journey. If you haven’t activated your account yet, open a Demat account with a DP and request Mero Share access today. It’s your key to participating in one of the fastest-growing sectors of Nepal’s economy.